Table of Contents

Could you start by summarizing your career background, and what led you to the role of CEO at DNAnexus?

My career really has unfolded in two major chapters.

For a little over a decade, I was a strategy consultant. I worked as a senior adviser to Fortune 1000 companies, primarily in technology and aerospace, focusing on strategy, market expansion, new product launches, and M&A. Toward the end of that period, I was looking for an industrial sector to call home, and I had the opportunity, almost overnight, to take over a small healthcare business that was struggling. I fell in love with the space.

What drew me to healthcare was the purpose - the opportunity to improve patient outcomes and people’s lives - but also the sheer complexity of the US healthcare system. At first, it felt like a mountain to climb, but I quickly realized that if I committed to healthcare, I’d never run out of meaningful problems to solve. So, I decided to stick with it.

Over the past 15 years, I’ve served as a chief executive across a range of healthcare businesses: SaaS software, technology-enabled services, platform and data companies. I’ve operated across multiple segments of healthcare, including providers, payers, life sciences, and medical devices.

As a result, I’ve really spent these years as a student of life sciences and healthcare, and I’ve developed a strong appreciation for the emergence of precision health as a data-driven, collaborative discipline.

When the opportunity came with DNAnexus, I spent time studying the company and found it really compelling. DNAnexus is a very distinctive asset. There really aren’t other companies with this level of scale and robustness.

For me, DNAnexus is the right platform at the right moment in the market. That’s rare. Often when you innovate, you’re either too early in the market and your product doesn’t fully achieve market fit. Or, you’re late and are forced to retrofit your solution. Here, because of the work done over the past 16 years, the company is exceptionally well positioned to deliver real value to the market today.

What data do you have and how are you advancing your capabilities?

DNAnexus is a pioneer in cloud-based multiomics bioinformatics. The company was founded 16 years ago by a talented team coming out of Stanford University. Over that time, it has established itself as the leading multiomics-based bioinformatics workbench for the precision health industry.

Today, we serve hundreds of large enterprise customers, typically the largest organizations in their sectors, across the full continuum of medicine.

That includes large drug developers and biotech. We’re present in the vast majority of the top 20 pharma, with more than 40 customers in that sector, alongside many mid-market biotechs. We also serve diagnostic and next-generation sequencing (NGS) companies, including major reference labs, many of whom use our platform in production.

We serve health systems and care delivery organizations as well, including academic medical centers and pediatric hospitals across the US and internationally. We also serve biobanks - large governmental initiatives focused on population health around the world. The largest UK biobank runs exclusively on our platform. And finally, we work with regulators as well, the FDA being a large customer.

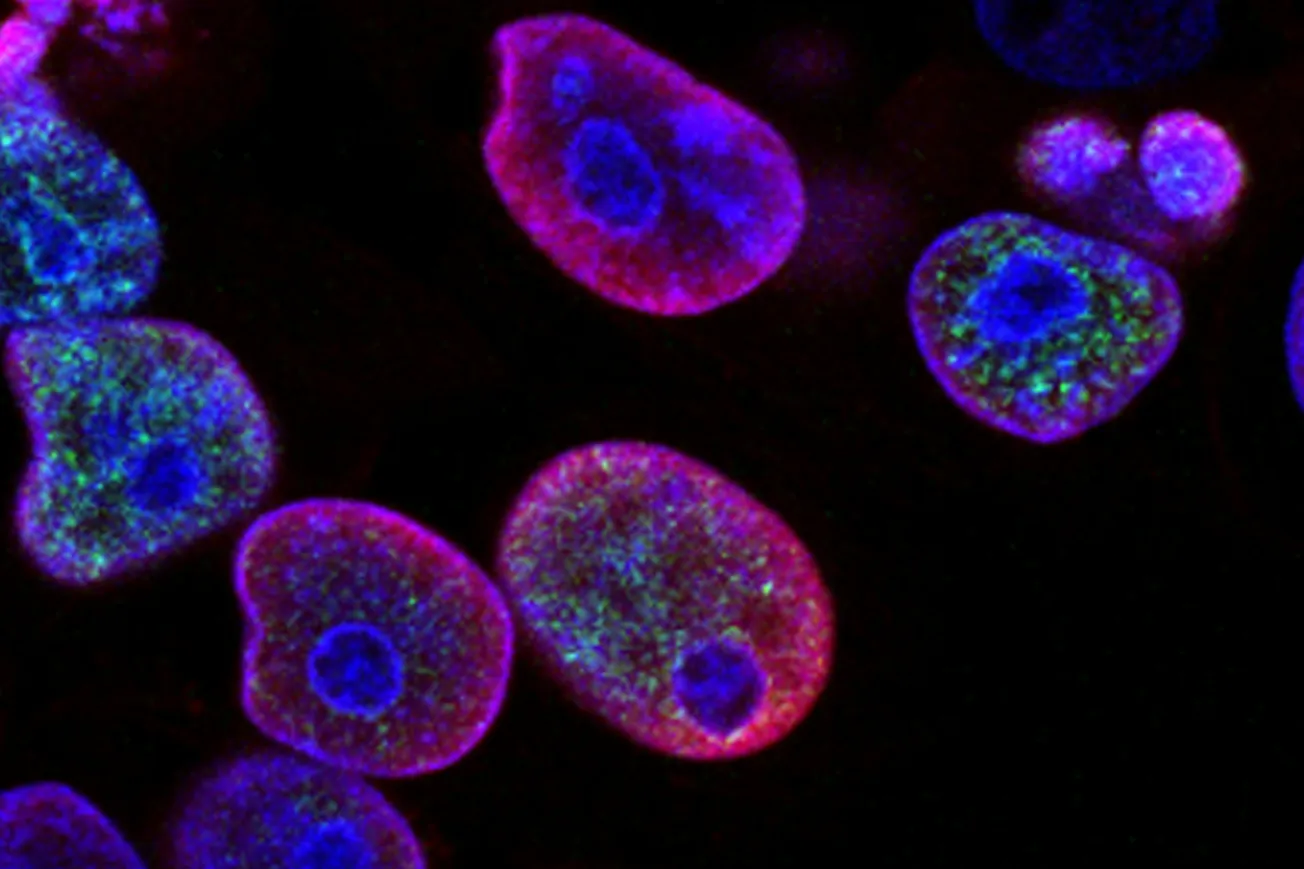

Across all of these end markets, what we do is help organizations ingest extremely large, multimodal data sets with an omics component. Sometimes, that’s DNA data, but increasingly it goes beyond genome or exome. It’s truly multiomics - transcriptomics, RNA, protein expression, metabolomics - combined with clinical data.

We help customers ingest that data at scale, prepare it, and normalize it for analysis. We then provide a workbench, where the data can be exposed to hundreds of informatics tools and algorithms within the platform. From there, customers can securely derive clinical insight.

As a result, we operate a large, highly secure, compliant informatics and collaboration workbench. We’ve reached a point where we’re truly industrial in scale, with north of 150 Petabytes of data on the platform. We are, by far, the largest custodian of genomic and omics data in the world.

We do not have data rights by design. Our business model is to act as custodian of this data on behalf of our customers. Through our software and platform, we help them derive insight and capture value, but we do not recycle or commercialize the data ourselves. We are, in that sense, the Swiss vault of omics data informatics.

Where are you taking the business from here?

If you take a step back and look at what’s happening outside the company, our environment really spans the full continuum of care. We’re active across all healthcare segments.

What we’re seeing is an acceleration of molecular testing. More omics and molecular data is being generated in clinical settings as a standard practice of care, and that diagnostic data increasingly feeds population health efforts.

At the same time, particularly in oncology and complex diseases, you’re seeing increased drug development of therapeutics that take into account not only phenotype but molecular profile and genetic makeup. As a result, there’s a rapid accumulation of omics data across healthcare.

Historically, genomic data was used as a point solution. You run a test, diagnose an individual or a cohort, make a therapeutic decision, and that’s it.

What we’re hearing from customers, now, is different. They still process standard informatics, but are now facing much larger amounts of molecular data. They need to treat it as a first-class asset. They can’t extract value just once. They need to normalize it, store it, access it over time, and re-access the insight.

In pharma, for example, exome sequencing used to be tied to a single drug development effort - one drug, one subset of patients. Now, companies are saying they need to re-access those results for label expansion, drug repurposing, improved safety models, and ongoing insight generation like patient recruiting for future trials.

That’s where we’re taking the platform. We started this transition about two years ago, and the company is really accelerating. We’re moving from a platform focused on workflow execution - generating insight one informatics algorithm at a time - to a platform built for ongoing orchestration.

At this stage, DNAnexus has effectively become the orchestration layer, or operating system, for omics-based informatics. We normalize data around a standard schema or data framework. In the past, this data was constellated across formats and couldn’t be matched or reused.

By normalizing it and enabling large-scale collaboration, we’re helping unleash the power of omics, and creating a platform where data can be accessed repeatedly for ongoing value creation. That shift - from execution to orchestration - is what we’re doing.

Could you give us a breakdown of who you’re engaging with and how demand is shifting among those groups?

We have customers all over the world.

We cover the full continuum of care. In pharma, we’re present in roughly 18 of the top 20 companies with more than 40 customers overall. We serve diagnostics as well, including large reference labs and next-generation sequencing providers running production platforms. We have more than 45 health system customers globally, along with multiple biobanks around the world. On the regulatory side, today the FDA is a major customer and we’re in the process of signing with regulators in other geographies.

Across those organizations, the research community using our platform represents over 60,000 bioinformatics professionals. At that point, you’re talking about operating at a scale that’s truly industrial.

In terms of demand patterns, we’re seeing genomics and omics move from research projects into production workflows.

In pharma, omics used to live primarily in early R&D - target identification and biomarker work. Now, we’re being pulled into clinical trials, where customers need the platform to support patient identification, trial protocol definition, safety analysis, and insight around drug repurposing and label expansion. These are much larger budgets and core workflow engines.

Historically, in diagnostics, companies were very transactional. They ran tests, pushed data, and returned results. Now, they want to structure that data as an output, recycle, and start to commercialize it.

In health systems, in the past, we supported the research side of academic medical centers, not the point of care. That’s changing. We announced a strategic partnership with Oracle, which acquired Cerner and now operates as Oracle EHR.

We’re embedded in the design of the new EHR as a precision health clinical module. That system launches in the second half of 2026 and will scale in 2027. Through it, we’re helping care providers make sense of molecular testing results at the point of care, contributing as a clinical support tool. That’s a shift from research into production, directly in front of clinicians.

For regulators, we were previously used primarily as a research environment. Now, we’re being pulled into regulatory submission workflows, particularly for personalized drugs with genomic definitions, where the data requirements are broader and more complex and a global standard gateway is needed.

Across all these segments, the customers’ message is the same: we need you beyond research. We need you in clinical development, drug regulation, care delivery, and production-grade workflows.

Can you talk about the costs associated with running DNAnexus’ cloud infrastructure and how you manage them as you scale?

There are two main cost drivers for us: compute and data storage, including data egress. The data is dense.

We’re focused on offering an efficient price point, so customers can do more. When we build our technology, there’s a strong emphasis on both of these dimensions, but increasingly the focus is on compute rather than storage.

Compute is intensive. It involves AI, large models, and expensive chips. That’s the battlefield we’re focused on - creating efficiency at the compute layer. We are an intelligence layer.

How do you position yourself in the wider industry, and what competitive pressures are you facing?

Given the number of customers we serve, the amount of data on the platform, and the size of our engagements, we’re really in a group of a select few. There isn’t a consistent set of competitors we are seeing over and over.

We do see smaller companies, occasionally. But, often, the friction is large customers saying that they’re going to build it themselves.

That creates an education challenge. Omics data isn’t the same as clinical data. It’s heavier, denser, and fragmented across many formats, and organizations often underestimate the complexity, time, and investment required to manage it effectively and securely.

At the same time, we’re seeing an evolution in demand. Informatics platforms used to be very opinionated, with fixed interfaces and workflows. Today, those conversations are increasingly driven by AI agendas. Customers want flexibility at the last mile. They want to bring their own models, apply their own tools, and report the data in their own way.

So, we’re evolving with that demand. Our platform remains tightly defined around security, compliance, and scalability - it’s a vault and a workbench - but we’re adding flexibility, at the last mile, through APIs and extensibility.

We’re moving from fighting DIY to enabling it. The friction becomes collaborative rather than competitive, which is an exciting shift for us.

Looking ahead, what defines success for DNAnexus over the next few years?

Our mission is to be an enabling platform for precision health. Success comes down to impact. Are we helping pharmaceutical companies derisk and accelerate clinical trials to bring more drugs for complex and rare diseases to market? Are we helping those drugs move through regulatory approval faster? Are we assisting physicians at the point of care and helping them identify the right therapy for complex diseases?

If precision medicine becomes a standard of care, that’s success for us.

With the Oracle partnership, could you outline the vision for patients?

Many of the details haven’t been announced yet, but Oracle acquired Cerner with the ambition of rebuilding the EHR as a truly clinical, data-driven system.

They believe in molecular, data-driven medicine. We’ll be the molecular infrastructure within that system. At the point of care, physicians will have support in deciding what tests to order. Results from molecular sequencing will flow through our module and be surfaced directly in the EHR interface.

We will then wrap intelligence and context around those results. What do they mean for this patient? What therapies make the most sense, given the molecular profile and disease stage? We’re building things like molecular tumor boards and dynamic knowledge environments, with refreshed annotations and interpretations over time.

It’s one of the clearest manifestations of precision health moving closer to the patient. Organizations like ours, which not long ago were focused on research, are now operating on the last mile of care delivery.

Is there any option for a data marketplace?

We took a very clear line: we’re not pursuing data as a commercial asset. We are custodians of data and provide the informatics and intelligence layer.

Healthcare data will be federated. It’s heavily regulated and protected. Omics data can’t truly be de-identified. This data won’t move. The algorithms will travel to the data.

What we’re enabling is distributed learnings by querying federated data. We normalize data across nodes, run computation where the data lives, and converge the findings. We’re not the marketplace. We’re the infrastructure on which data marketplaces operate.

Comments